How Does Leverage Explain the Difference Between Roa and Roe

If a firm can borrow money and use it to achieve a higher return than the cost of the debt then the leveraging creates additional revenue that accrues to stockholders as increased equity. Net profit after taxesTotal assets.

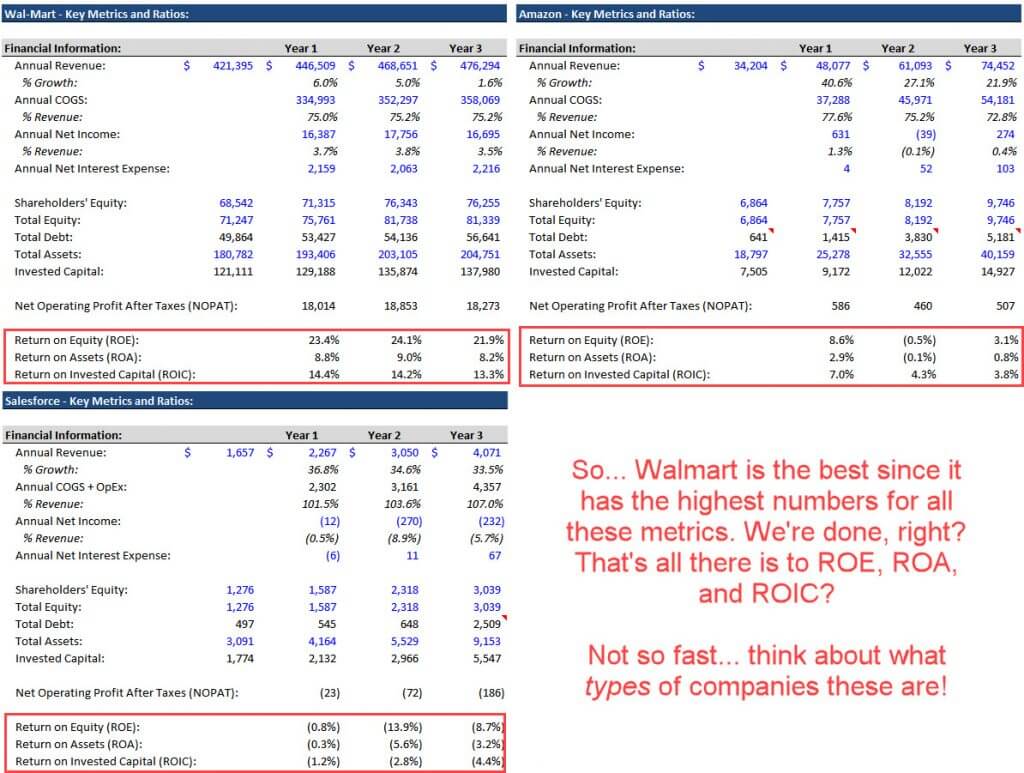

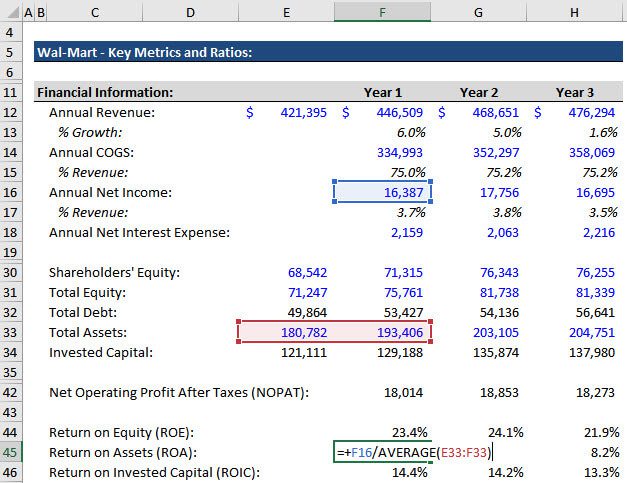

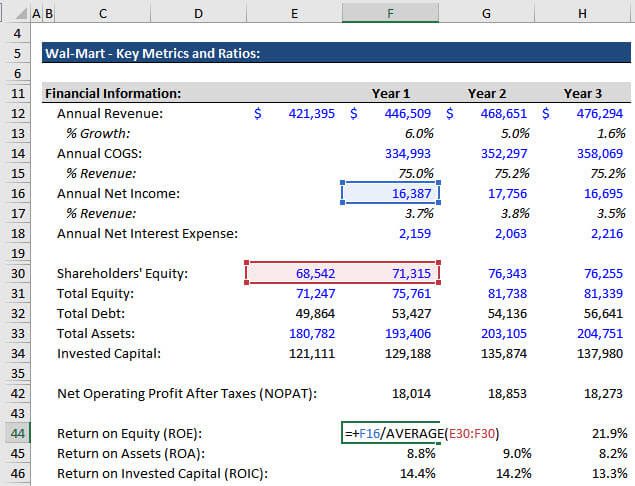

Roic Vs Roe And Roe Vs Roa Key Financial Metrics And Ratios

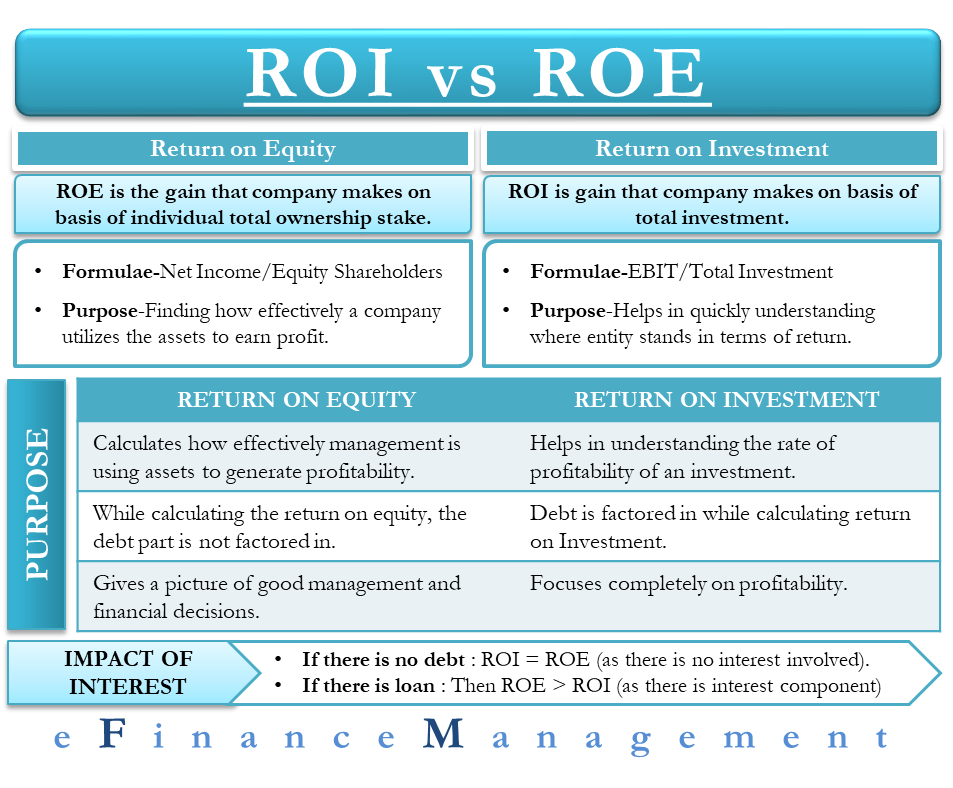

ROA and ROI are two vital measures that can be used in this exercise.

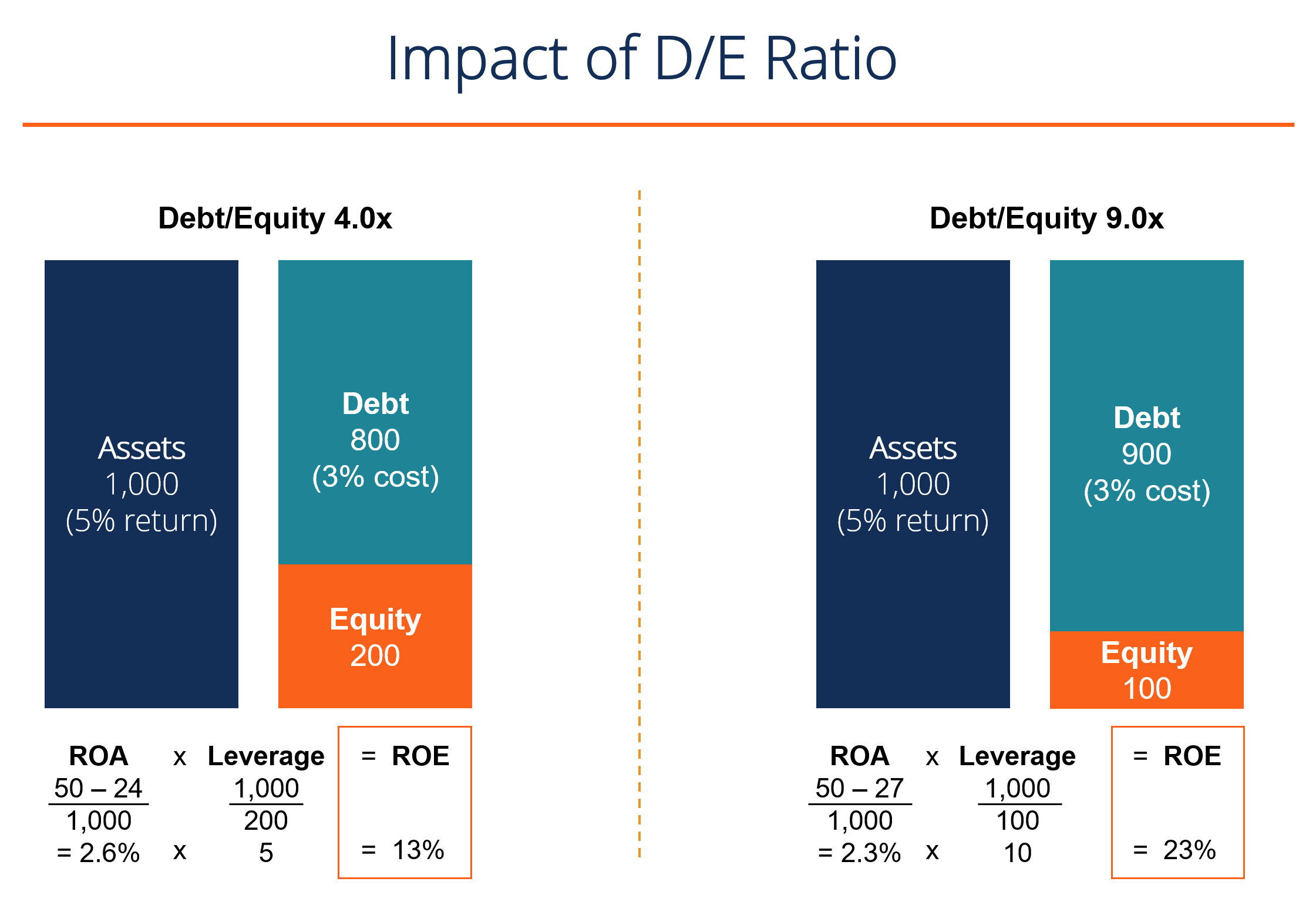

. However financial leverage really increases the variability of a companys net income and its return on equity. Lets say the net income for Company XYZ in the last period was 21906000 and the average. The Difference Is All About Liabilities The big factor that separates ROE and ROA is financial leverage or debt.

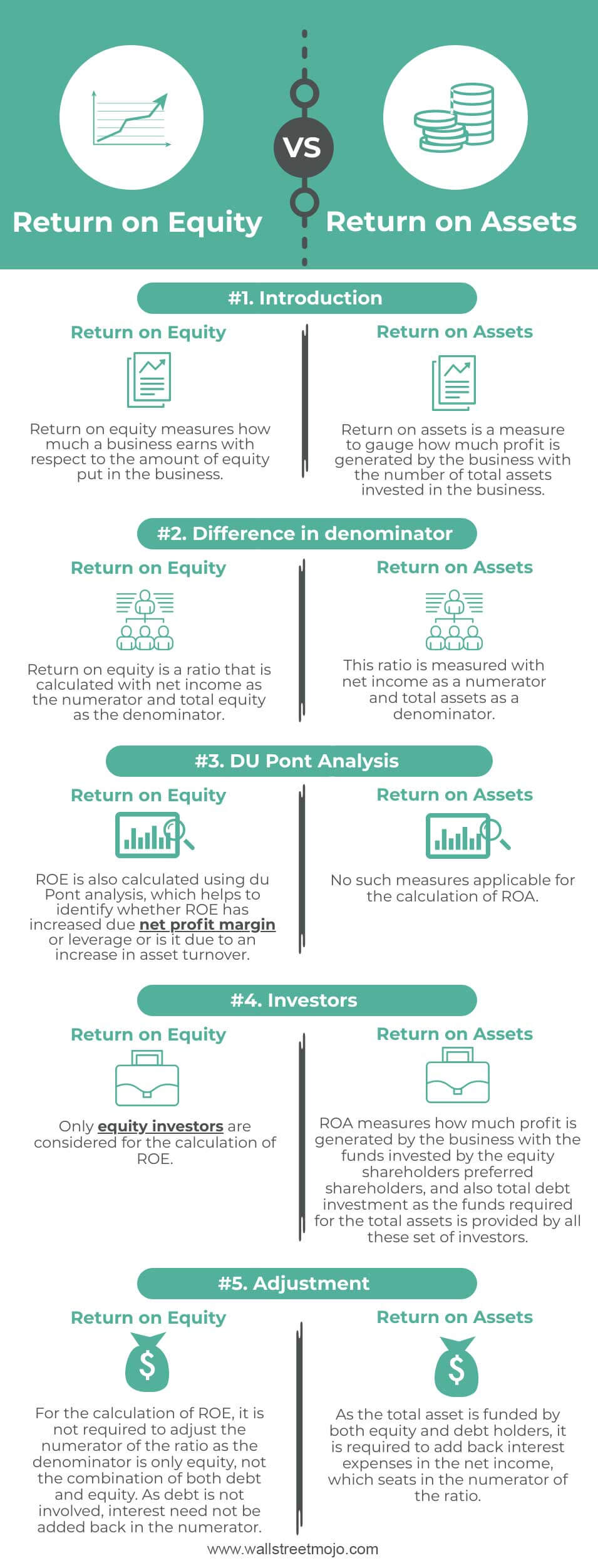

1ROE is Return on Equity while RNOA is Return on Net Operating Asset. This is the key difference between ROA and ROI. RoA is return on assets.

ROA Return On Assets calculates how much income is generated as a proportion of assets while ROI Return On Investment measures the income generation as opposed to investment. It is one of the best measure of performance of an entity from the shareholder perspectiveSo it helps us to know. This ratio measure for the operating.

The balance sheets fundamental equation shows how this is. Change of EBIT is more than Change in Sale If change of earning before interest and tax is more than change in sale this operating leverage will effect ROE positively because at this level per unit. The major factor that separates ROE and ROA is financial leverage ie.

1- Return on assets ROA ratio. 2The formula for ROE is net income after taxes divided by shareholder equity while the formula for RNOA is net income divided by total assets. Overview and Key Difference.

ROE measures the efficiency of capital or financial management. Heres how to calculate the return on assets ROA ratio. View the full answer.

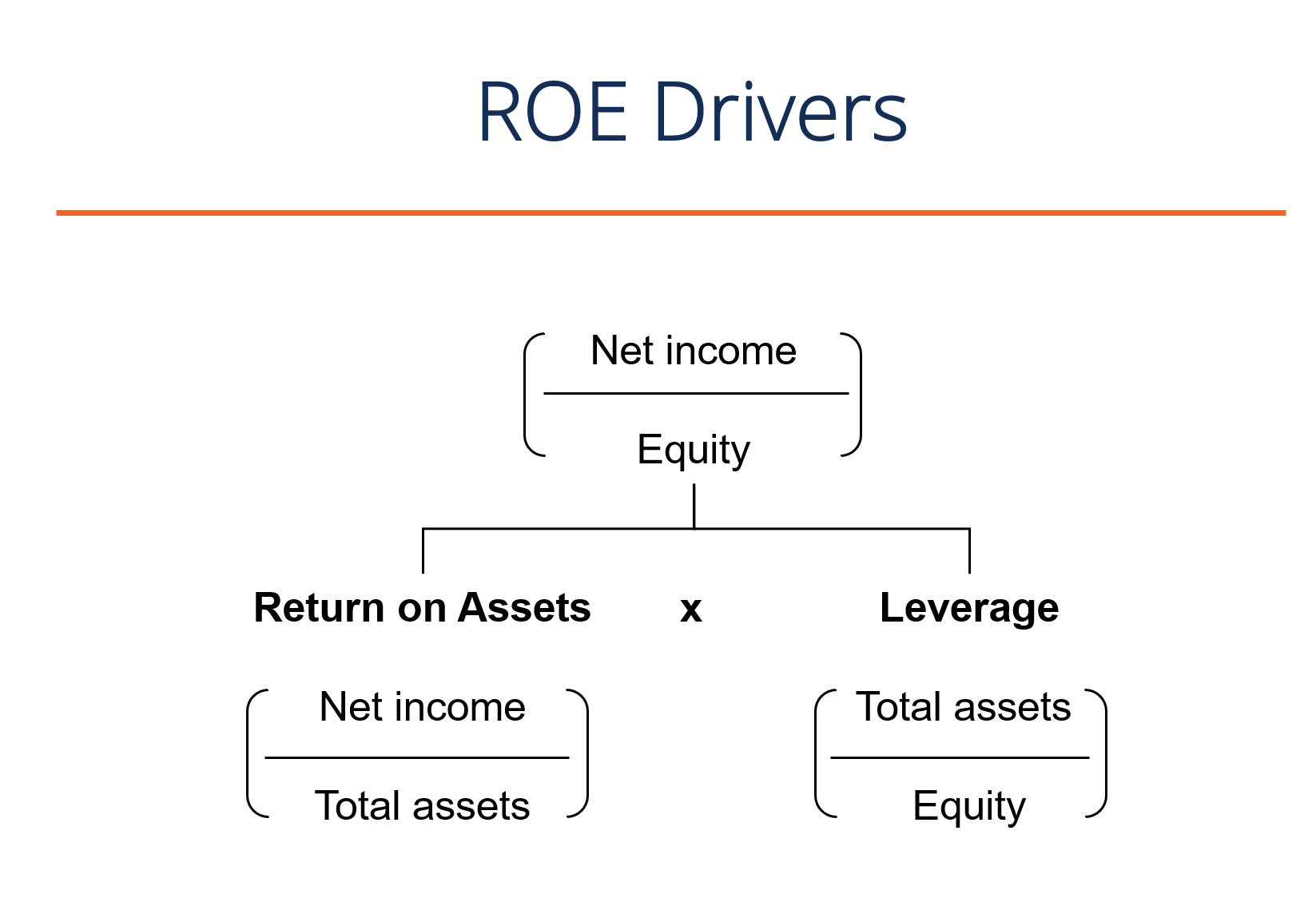

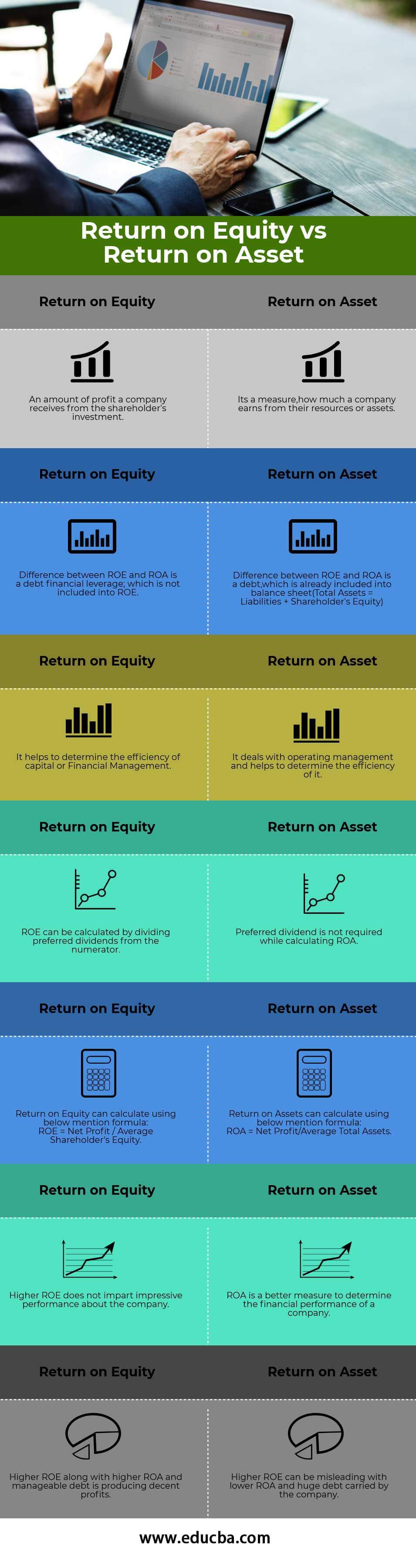

In the DuPont equation ROE is equal to profit margin multiplied by asset turnover multiplied by financial leverage. Debt is included in ROA which can be clearly seen in the balance sheetTotal Assets Liabilities Shareholders Equity 3. A high degree of financial leverage implies that a company has high levels of interest payments which could negatively impact its net income bottom-line earnings per share as well as return on equity ROE.

Return on equity ROE and return on assets ROA are two key measures to determine how efficient a company is at generating profits. If we talk the leverage effect on ROE it means we talking operating leverage effect financial leverage effect and combined leverage effect on ROE. It measures a firms efficiency at.

Simply the operational profit divided by the total assets. And the amount of financial leverage Financial Leverage Financial leverage refers to the amount of borrowed money used to purchase an asset with the expectation that the income from the new asset will exceed the cost it has. In most cases the bulk of the difference between return on assets and return on equity is debt.

One major difference between ROE and ROA is debt. Return on equity is the rate of return on the shareholders equity of a companys common stock owners. From a companys perspective the use of financial leverage can positively - or sometimes negatively - impact its return on equity as a consequence of the increased level of risk.

On the other hand if the company with a 20000 profit had only 150000 in assets it has an ROA above 13 percent. This means that in this scenario ROE and ROA will be equal. Now if the company decides to take a loan ROE would become greater than ROA.

A better name for ROE is the return on average equity since like ROA it is more descriptive of how ROE is actually calculated. I is the average interest paid on the financial debts. Return on Equity is the return earned by company on its average equity.

Accounting questions and answers. To calculate the return on equity you need to look at the income statement and balance sheet to find the numbers to plug into the equation provided below. A higher ROE is not always an indicator of an impressive.

A 50000 profit looks better than 20000 on paper but if the company has 25 million in assets its a paltry 2 percent ROA. The calculations are pretty easy. Under DuPont analysis return on equity is equal to the profit margin multiplied by asset turnover multiplied by financial leverage.

Return on assets is about percentages not raw figures. There you have it. Operating Leverage Effect.

4 Explain how return on net operating assets RNOA and financial leverage FLEV affect Return on Equity ROE. Therefore RoA i is what we call the excess return normally the positive difference between what the return of your operation is and the cost of your loans to finance that operation. By splitting ROE return on equity into three parts companies can more easily understand changes in their ROE over.

5 Explain the. Is greater FLEV always better. The ratios of the return on assets ROA and the return on owners equity ROE are the most used profitability ratios in the analysis.

ROA tends to tell us how effectively an organization is taking earnings advantage of its base of assets. A good part of a businesss net income for the year could be due to financial leverage. Return on Assets ROA is a type of return on investment ROI metric that measures the profitability of a business in relation to its total assets.

Return on Equity ROE is generally net income divided by equity while Return on Assets ROA is net income divided by average assets. This ratio is calculated as net profit after tax divided by the total assets. This equation uses net operating assets which equals total assets less the non-interest-bearing operating liabilities of the business.

Impact on Return on Equity. If there is no debt shareholders equity and total assets of the company will be same. With return on assets what makes for a good.

Return on Equity Net Income Average Common Stockholder Equity for the Period 1. 3 What is the difference between the traditional ROA measure part of the traditional DuPont analysis and the return on net operating assets RNOA. It is calculated by using the formula Net IncomeAverage equity.

But what do they mean. A company that borrows a lot of money is going to have a significant gap between its total assets and its total equity and that will translate into a big difference in the. The main differentiator between the two is that ROA takes into.

EBIT Net operating assets ROA. How does financial leverage explains the difference between ROA and ROE.

Return On Equity Roe Formula Examples And Guide To Roe

Roe Vs Roa Top 5 Differences With Infographics

Roic Vs Roe And Roe Vs Roa Key Financial Metrics And Ratios

Chapter 19 Financial Statement Analysis Investments Bodie Kane

Relations Between Roa And Debt Levels Download Table

Business Finance Michael Dimond Ppt Download

Return On Assets Roa And Return On Equity Roe Fundamental Analysis Youtube

Dupont Analysis Roa And Roe New Function In Invest For Excel Datapartner Software

Roe Vs Roa Top 7 Differences To Learn With Infographics

How To Calculate Return On Equity With A Dupont Analysis

Roe Vs Roa Top 7 Differences To Learn With Infographics

Dupont Roe Calculation Financial Leverage Return On Assets Roa Explained Driveyoursucce

Roe Vs Roa Top 5 Differences With Infographics

Pdf Predictors Of Return On Assets And Return On Equity For Banking And Insurance Companies On Vietnam Stock Exchange Semantic Scholar

Pdf Financial Leverage And Its Effect On Return On Equity Roe And Earnings Per Share Eps An Empirical Of Mining Industry Listed In Indonesia Stock Exchange Semantic Scholar

Return On Assets Roa Site Economics

Roi Vs Roe All You Need To Know

Comments

Post a Comment